Stay Safe (Financially) During COVID-19

Lifestyles have changed a lot during COVID-19. One of those changes has been e-commerce – or online – purchases. They’re up almost 35% this year, which is probably not a surprise.

What many people may find surprising is the resulting increase in fraud cases. Fraudsters prey upon times of uncertainty and lifestyle change. Ranging from asking you for financial information and resubmission of ‘lost’ payments, to confirming recipient information ‘so you get your stimulus check’ or personal information regarding ‘potential COVID-19 exposure,’ the latest schemes reflect the times.

COVID-19 And Stimulus Fraud Reports by Federal Trade Commission numbers (through July 9th):

- 64,990 reports

- $81 million in losses

- $274 median fraud loss

- Primary sources of fraud reports have been online (29%) and travel/vacation (23%)

The reason for this article isn’t to scare you but to let you know the problem is out there and some ways to help protect yourself. For instance, while we may contact you regarding account activity, we will never call or email you out of the blue to confirm your financial or personal information (social security, account or credit card numbers, as examples). If anyone ever does this or asks you to pay by MoneyGram, Western Union, bit coin, online payment service, load a gift card – it’s a scam, plain and simple.

Another thing to look for – especially online – is to be careful what you click on. If you receive a message that appears strange - even from an email address you know - don't open it. Or you may find a message that doesn't 'sound' like it would come from that person or even no message at all, just a link. Don't click on the link and just delete the message as it may introduce a virus to your computer.

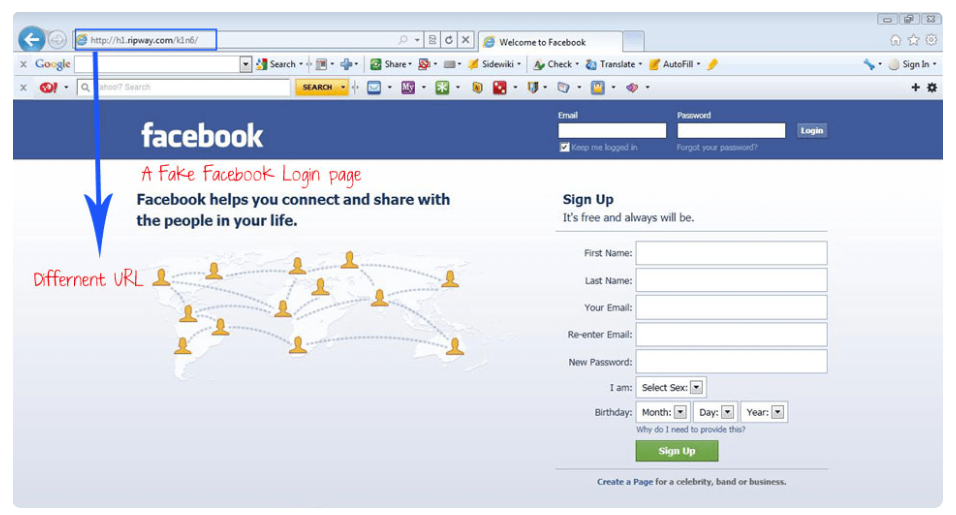

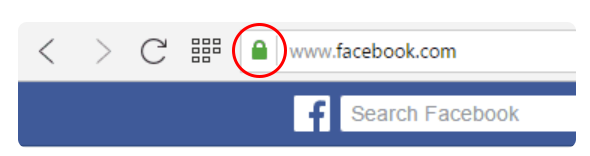

Other scams that have picked-up pace recently are those targeting social media where links to fake pages are sent. Once you get to the page, it may seem legitimate until you take a closer look: